washington state sales tax everett wa

2020 rates included for use while preparing your income tax deduction. The average cumulative sales tax rate in Everett Washington is 1006.

Washington Sales Tax Guide And Calculator 2022 Taxjar

2020 rates included for use while preparing your income.

. Everett is located within Snohomish County. Bring your questions at 10 am. The Everett Washington sales tax is 970 consisting of 650 Washington state sales tax and 320 Everett local sales taxesThe local sales tax consists of a 320 city sales tax.

Use this search tool to look up sales tax rates for any location in Washington. Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington. Look up a tax rate.

It is comprised of a state component at 65 and a local component at 12 38. Quarterly tax rates and changes. Lowest sales tax 75 Highest sales tax 106 Washington Sales Tax.

This includes the rates on the state county city and special levels. This rate includes any state county city and local sales taxes. 2022 List of Washington Local Sales Tax Rates.

Use tax is a tax on items used in Washington when sales tax hasnt been paid. Retail Sales and Use Tax. What is the sales tax rate in Everett Washington.

The County sales tax rate is. The motor vehicle saleslease tax of three-tenths of one percent 03 on motor vehicles also applies when use tax is due on a vehicle. This is the total of state county and city.

The City of Everett Business and Occupation Tax BO is based on the gross receipts of your business. Rates include state county and city taxes. Use our local tax rate lookup tool to search for rates at a specific address or area in Washington.

Download the latest list of location codes and tax rates alphabetical by city. There are a total of 105 local tax jurisdictions across the state collecting an average local tax of 2368. Use tax is paid at the time a vehicle is registered with.

The latest sales tax rate for Everett WA. The latest sales tax rate for Seattle WA. 2020 rates included for use while preparing your income tax deduction.

Combined with the state sales tax the highest sales tax rate in Washington is 106 in. This rate includes any state county city and local sales taxes. 2 Washington has state sales tax of 65 and.

The Everett sales tax rate is. An alternative sales tax rate of 106 applies in the tax region Snohomish which appertains to zip code 98208. This is the total of state county and city sales tax rates.

ZIP--ZIP code is. Use our local tax rate lookup tool to search for rates at a specific address or area in Washington. The Washington sales tax rate is currently.

Search by address zip plus four or use the map to find the rate for a specific location. 31 rows The latest sales tax rates for cities in Washington WA state. Youll find rates for sales and use tax motor vehicle taxes and lodging tax.

To calculate sales and. The 4 is optional. Person must pay the tax and may then take a credit equal to the state share of retail sales tax paid.

Average Sales Tax With Local. The minimum combined 2022 sales tax rate for Everett Washington is. 98201 98203 98206 98207 and 98213.

When you purchase a vehicle or vessel from a private party youre required by law to. The Sales and Use Tax is Washingtons principal revenue source. An alternative sales tax rate of 105 applies.

What is the sales tax rate in Everett Washington. The Everett Washington sales tax is 970 consisting of 650 Washington state sales tax and 320 Everett local sales taxesThe local sales tax consists of a 320 city sales tax. The Everett Washington sales tax rate of 99 applies to the following five zip codes.

Download the latest list of location codes and tax rates for cities grouped by county. The minimum combined 2022 sales tax rate for Everett Washington is 98. Lists of local sales use tax rates and changes as well as information for lodging sales motor vehicles sales or leases and annexations.

Judge Clears Way For Challenge To Washington S New Capital Gains Tax 790 Kgmi

Closing Costs In Washington State

Washington State Sales Tax Rate Usgeocoder Blog

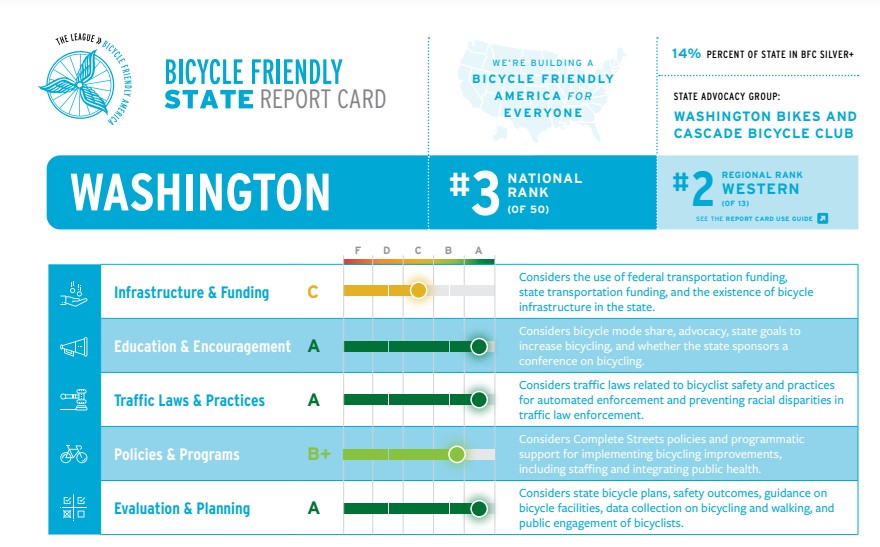

Blog News Washington Bikeswashington Bikes

Washington State Sales Tax Rate Usgeocoder Blog

Tax Negotiations In Washington 20 20 Tax Resolution

Washington State Sales Tax Rate Usgeocoder Blog

Washington Sales Tax Rates By City County 2022

Washington Sales Tax Guide For Businesses

Washington Sales Tax Small Business Guide Truic

Graduated Real Estate Tax Reet For Snohomish County

Washington State Sales Tax Rate Usgeocoder Blog